LATEST NEWS

Read all our latest news articles

Deferred Debit Cards

Merchants and Payment Services Providers (PSPs) generally deal with three main types of card; Debit Cards, Credit Cards and Charge Cards. The rules and processes surrounding each of these card types has for the most part been clear...

Know more about PCI DSS compliance

We have just published our new booklet “The Truth about PCI DSS compliance in contact centres”, a compilation of blogs discussing many of the issues around this complex subject. Although the Payment Card Industry Data Security Standard (PCI DSS)...

Ditch the CVV

There are a number of myths around the three-digit card verification value (CVV) code found on the back of a MasterCard or Visa card (four-digits on the front if paying by American Express). However, is it time to ditch the code...

Green Star Energy Press Release

Green Star Energy, one of the newest entrants into the UK’s competitive residential energy market, has deployed interactive voice response (IVR) and automated payment technology from Encoded to offer customers a 24-hour meter reading...

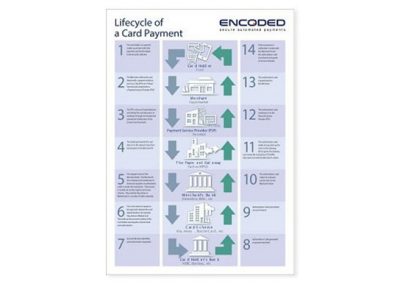

A day in the life of a contact centre card payment

Have you ever thought about what happens once you enter your debit or credit card details into an automated system or read them out to a contact centre agent? The answer isn’t easy but it is more straightforward than many would like you to believe...

Six Design Tips to Improve IVR

Ask people in the street about interactive voice response (IVR) systems and you are likely to get very different viewpoints. Loved by many as a quick way to make a payment, check a balance or top up credit on a mobile ‘phone, many customers...

Five reasons why every contact centre should have a PCI DSS Compliance Programme in place

With Christmas fast approaching, contact centres are starting to prepare for increased calls and transactions. However, with payment card fraud continuing to rise and data theft constantly in the news, non-PCI DSS compliant contact centres...

Whose responsibility is it anyway?

The Payment Card Industry Data Security Standard (PCI DSS) was originally the brainchild of the world’s five largest payment card providers VISA, MasterCard, American Express, Discover and JCB International. Today, it is a global framework...

Wise up on PCI DSS and Save a Fortune

Every contact centre that accepts credit and debit card payments over the telephone needs to be PCI DSS (Payment Card Industry Data Security Standard) compliant. However the process of becoming and staying compliant can be hugely expensive...

White paper – Telephone Payments and PCI DSS

Making payments via a credit or debit card is now largely common place but the regulations around accepting card payments over the phone remains a mystery to most organisations. This is your chance to read the ultimate white paper...

Five things you should know about PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) remains surrounded by confusion and misinformation. For example many call centres do not appreciate that PCI DSS covers the entire trading environment including all third-party partners and vendors...

Three Ways to De-scope to Save Money

Every business or merchant that accepts payment via debit and credit cards has a contractual obligation with its bank/acquirer to be PCI DSS ...