Every business or merchant that accepts payment via debit and credit cards has a contractual obligation with its bank/acquirer to be PCI DSS compliant. The Payment Card Industry Data Security Standard (PCI DSS) is made up of 12 requirements designed to standardise controls surrounding card holder data and to help protect consumers and merchants against security breaches.

To become PCI compliant the 12 requirements, consisting of 258 controls, must be implemented and the cost of this to a business can range from the tens of thousands to the tens of millions of pounds. To many the costs involved can be prohibitive but there is money to be saved by undertaking a program of reducing the scope of the cardholder data environment. This is called de-scoping and reduces the number of requirements (tick-boxes) for PCI Compliance.

Here are three ways to de-scope your business:

1. Pass the responsibility to a third party

2. Tokenisation

3. Work with a PCI compliant payment solutions supplier

Why de-scoping saves money

Taking areas of an organisation’s business out of the scope of PCI compliance minimises the cost and complexity associated with PCI DSS standards. As mentioned before a PCI project can cost anything from £10k to several millions of pounds plus there is a requirement for quarterly network scans and an annual audit.

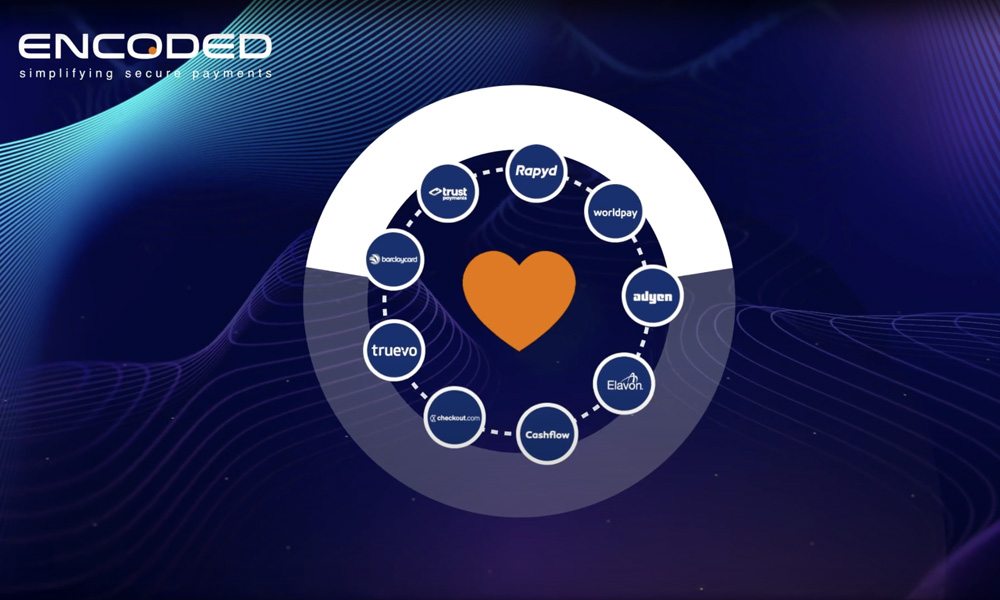

Remember the buck stops with the merchant to ensure PCI compliance. However, whether customer card data is handled within a contact centre, via web pages or a chip and pin terminal, PCI compliant payment company Encoded, offers solutions to ensure compliance is achieved with minimum cost and maximum security.

Encoded is a leading provider of interactive voice response and automated payment solutions. It is also Level 1 PCI DSS Compliant.

To find out more and to talk about how Encoded can help save you money and protect your payment business please call Rob Crutchington on 0845 120 9790.