The Ultimate Guide to IVR Payments for 2024

In our guide below you’ll learn what is IVR, payment solutions, key features, case studies and benefits.

- Learn what is IVR and how it does it work

- Learn what are the key features of IVR

- Learn what are the benefits of IVR

Table of Contents

Click on any chapter title below to scroll directly to the chapter.

Chapter 2. What is IVR and how it does it work?

- What is IVR?

- What is IVR authentication?

- What are the best IVR payment solutions?

- What are the costs of IVR payments?

- What is needed for IVR payments?

- What about integration with other systems?

- How secure are IVR payments?

Chapter 3. What are the key features of IVR?

- Automation

- Security

- Round-the-clock business operations

- Seamless integration

Chapter 4. What are the benefits of IVR?

- Makes the most of agent time, maximise resources

- Enhances customer payment and data security

- Improves your customer experience

- Increases your productivity

- Enables a joined-up customer service

Chapter 5. A checklist for choosing an IVR payment system

- Does it provide secure customer authentication?

- Is it flexible to manage fluctuations in demand?

- Does it integrate with your existing systems?

- Finally – measuring the right metrics

Chapter 6. Case studies

- Exact Mortgage Experts

- Virgin Holidays

- First Port Property Services

- Anglian Water

- Appreciate Group

Why Encoded?

Encoded is a Level 1 PCI DSS accredited supplier – which means that contact centres and their customers can rely on Encoded’s technology with absolute confidence.

Chapter 1. Introduction

As a result of the 2020 Coronavirus pandemic there was a rush for contactless payment methods as never before. The maximum amount for contactless payment was increased by 50% with many shops not accepting cash. According to financial services and information management consultancy Futurist Group, about 38% of consumers now see contactless as a ‘basic need’ feature of payments, up from 30% a year ago. On the other hand, the percentage of consumers saying they don’t need contactless payments has fallen from 41% in March 2019 to 33% in March 2020. With this increase in more card payments, and more transactions being conducted either online or over the phone, the demand for IVR has also increased in contact centres and remote sales operations.

There are plenty of IVR payment services on the market, which makes it tricky to choose the best one for your business. In this article we outline what IVR is, how it works and what to look out for to suit your business.

With the right solution aligned to your organisation’s business systems, you can give your customers a smooth transaction process and great customer experience.

Download our guide to IVR Payments

Chapter 2. What is IVR and how it does it work?

Interactive Voice Response Payments (IVR Payments) is a payment method that allows callers to enter their card data via touch tones. It enables customer self-service to:

- make 24/7 payments without any agent involvement

- provide a secure ID to find information

- make payments from anywhere at any time using a telephone.

The second method of authentication is a customer ID number (i.e. invoice or customer reference), entered using touch tones on the telephone into the IVR payments system prior to taking their payment.

IVR payments are perfect for companies which experience seasonal spikes in calls, which would normally involve hiring extra temporary staff or paying costly overtime.

IVR costs five times less than a telephone call – with the right design and technology IVR can produce significant savings. Research from ContactBabel revealed that the average cost of a telephony IVR self-service session is 65p, compared to the cost of a live service telephone call where the mean average was £3.55.

Some IVR solution providers only charge for successfully processed transactions, which keeps prices transparent. It rewards both the third-party provider and its customers on success, keeping an active working relationship focused on service improvements.

IVR payments are far more secure than other traditional methods, which sometimes may include agents noting down credit or debit card details manually. Choosing a cloud IVR service payment solution ensures everything is fully automated and confidential – client data is stored within a secure cloud infrastructure.

Using IVR to accept payments from a trusted third party provider is also an easy way to achieve PCI DSS.

Chapter 3. What are the key features of IVR?

Need help?

Chapter 4. What are the benefits of IVR?

IVR can help to free agents from boring and repetitive work, reduce staff attrition and improve staff morale. Automated systems allow agents to spend time providing value added services, ensuring better use of their skills, while all the time improving the customer experience (CX).

“We have saved around 46 agent hours every month based on our current call volumes, an improvement that has vastly boosted our productivity.”

Fliss Dale, Director of Collections and Recovery at Exact

Typically IVR card payments are far more secure than the traditional manual handling of customer data. Choosing a cloud IVR solution from a PCI DSS approved provider means that confidential client data is stored securely, taking IVR payments out of scope for PCI DSS requirements.

“At Virgin Holidays, we take client confidentially very seriously and customers can trust us to keep their data safe when paying for tickets, weekend breaks or all-inclusive holidays, online or over the phone. That is why we invested in the latest Interactive Voice Response (IVR) payment solutions from Encoded to give our team and our customers complete peace of mind.”

Jessica Baker, Operations Analyst, Virgin Holidays

Capturing customer data means the latest information can be directed and displayed to agents with the best knowledge and expertise. Queries are resolved faster with greater customer satisfaction, helping to maintain the best possible ratings for those all-important customer feedback surveys.

“Dramatic improvements in efficiency and call flow have boosted agent morale and tangibly enhanced the overall customer experience”

Matthew Cook, Head of Customer Support, Bespoke and Property Services, First Port

IVR means your customer service is available 24x7x365, without any agent involvement. Customers can self-serve and make payments at any time and from anywhere.

“Using Encoded’s innovative technology means we are now open 24 hours a day, giving consumers the round-the-clock service they need to fit in with their busy lifestyles. They can make payments anytime, from anywhere quickly and securely. Last year, over 12,000 IVR payment calls were handled successfully, proof that the service is gaining rapid popularity with our customers.”

Julie Hall, Billing and Income Manager, Anglian Water

With your IVR solution connect to your finance and other critical business systems, your agents always have the latest information to deliver a joined-up customer experience.

“As a very seasonal business, our call volumes fluctuate wildly especially during peak times like Christmas when our calls can rise dramatically from approximately 1,000 to 5,000 per day. Encoded helps to deliver the high level of personal attention our agents deserve by taking care of straightforward payment calls and balance enquiries 24 hours a day, 7 days a week.”

June Potts, Head of Customer Contact, Appreciate Group plc

Key benefits of IVR Payments

- Reduced cost in comparison to agents taking payments

- Level 1 PCI DSS accreditation (with approved PCI DSS provider)

- Can provide seamless integration with existing business working methods

- The option to have comprehensive reporting including user behaviour analysis

- Full system redundancy backup with a 99.99% uptime SLA

Chapter 5. A checklist for choosing an IVR payment system

- Customers expect a speedy check-out service without their card details falling into the wrong hands. The latest IVR payment solutions allow contact centre users to enter their debit or credit card data via touch tones any time of day or night, quickly and securely.

- When looking for new technology, rather than choose a vanilla software vendor which may sell you a solution and leave you to it, consider a partner that will work with you throughout the compliance process. Look for a vendor happy to advise and educate while offering solutions that will help your contact centre to comply with the latest PCI DSS or GDPR legislation and the newly introduced Payment Services Directive (PSD2).

- Choose an IVR payment solution that can authenticate callers prior to taking payments either via a unique number like an invoice or customer reference. Then, shortlist those that integrate easily with in-house telephony, accounting and CRM systems. This means agents can deal with more customers and spend less time on taking payments. While customers feel secure in the knowledge that their card details are protected.

- An automated method of payment is perfect for companies which experience seasonal spikes in calls, normally requiring temporary staff of costly overtime. How a provider charges for successfully processed transactions is also important in your selection.

- There are also new advances in IVR, which include text-to-speech options for multiple languages. The choices mean that modern IVR solutions give customers the opportunity to choose between self-service and talking to a live agent. Either way, you can reduce your costs and enhance customer service.

- IVR payments have grown in popularity and importance as a result of the recent COVID-19 pandemic and an increase in the number of people working from home and MOTO (mail order/telephone order payments).

- They can work for both customers and remote-workers as they are accessible from anywhere whether in the office, at home, across time-zones, providers, carriers and telephony systems. Using one single solution, organisations can streamline their critical payment processes by centralising their IVR payments across multiple contact centres and link to multiple CRM systems to enhance customer service.

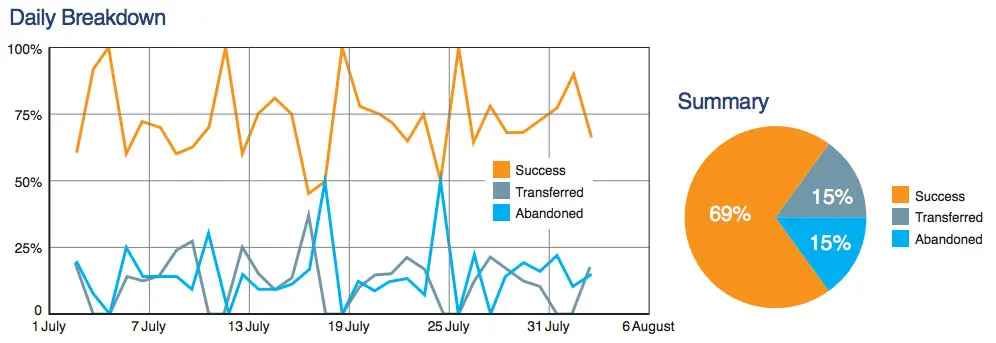

Finally – measuring the right metrics

Measuring the right metrics allows adjustments and changes to be made if the required results are not being achieved:

Successful transactions: for example, the number of customers who begin and complete a self-service transaction without live-agent assistance. When designed well, IVR self-service payments can result in up to 90% of relevant calls being dealt with automatically representing a massive cost saving, an improvement in customer service and a boost for the company’s reputation with its customer.

IVR abandonment rates: usually the most common metric, this reflects the number of customers that that drop out, prior to choosing an option in the IVR system. This number should be very low because customers tend to have the patience to navigate the system in the first instance before giving up. Typically customers do not drop out but instead transfer or “zero-out” to a live agent.

Transfer or Zero-Out rates: this is where a customer will “select zero to speak to an agent”. According to ContactBabel research carried out in 2015, the mean zero-out rate is 18%, however, with the correct set-up of IVR payment systems can reduce this number.

It’s vital to measure and report on the right metrics. Here’s a few questions to consider:

- What are the right key performance indicators (KPI’s)?

- What has your previous experience been?

- How can IVR payments help with PCI DSS* compliance?

Five reasons why every contact centre should have a PCI DSS Compliance Programme in place

With Christmas fast approaching, contact centres are starting to prepare for increased calls and transactions. However, with payment card fraud continuing to rise and data theft constantly in the news, non-PCI DSS compliant contact centres…

Whose responsibility is it anyway?

The Payment Card Industry Data Security Standard (PCI DSS) was originally the brainchild of the world’s five largest payment card providers VISA, MasterCard, American Express, Discover and JCB International. Today, it is a global framework…

Wise up on PCI DSS and Save a Fortune

Every contact centre that accepts credit and debit card payments over the telephone needs to be PCI DSS (Payment Card Industry Data Security Standard) compliant. However the process of becoming and staying compliant can be hugely expensive…

Chapter 6. Case studies

Jersey Telecoms

JT (Jersey Telecom) is a government-owned full service global communications provider, with its headquarters located in Jersey.

Founded in 1888, today it employs over 500 people with offices across the Channel Islands and around the world.

JT chose Encoded as a ‘one-stop supplier’ for a suite of solutions that could not only ensure compliance with the latest PCI DSS security standards but also enable them to merge multiple websites and contact centre operations.

“We were impressed with Encoded’s technical and commercial proposals, and their flexibility to meet changes as the project got underway. The team always kept the original project proposal on track for successful completion,” said Tim Peach, Finance Operations Manager, JT.

“One of the key reasons for choosing Encoded was to improve the team’s experience of managing large scale migrations from legacy payment systems. With Encoded’s in-depth knowledge of data security, PCI DSS compliance and the latest payment regulations, JT had confidence that the integration would be carried out within the project timescales and to budget.”

Tim Peach,

Finance Operations Manager, JT

Exact Mortgage Experts

Exact Mortgage Experts (Exact) was established in 2008 with the aim of providing a one stop solution for Asset Traders, while providing Mortgage Servicing and Asset Management for Banks and Building Societies.

Exact’s contact centre is open from 8am until 8pm, Monday to Friday and from 9am until 12 noon every Saturday. Every caller has the option to make a payment by speaking directly to an agent or via the new self-service automated payment solution from Encoded. Deployed in March 2013, the Encoded IVR system has become immensely popular.

The percentage of payments taken using Encoded has risen from 12% to 50% in the first six months alone. This represents half the total number of calls coming into the contact centre. Prior to Encoded, it took agents on average five minutes to answer a call, take the borrower through security, calculate and then process the payment. The number of agent hours saved has been significant.

One Savings Bank

The Wine Society

The Wine Society is the world’s oldest member-owned community of wine lovers.

Since 1874 the organisation has been doing business differently, putting members before profit to ensure fairer bottle prices and services for all. Today, more than 180,000 members have access to over 1,400 selected wines from around the world, at everyday low prices throughout the year.

As a member-owned co-operative, and therefore particularly mindful of the need to be as cost-effective as possible, The Wine Society required an all-in-one solution that combined fast, flexible service with blue-chip functionality at a competitive price.

According to Karen Coates, Chief Operations Officer, it was all about; “proportionality, a solution in our price range and in our size range that did the job and was easy to implement.”

“Encoded won hands down when it came to good customer service. We really liked the team and the fact they had done their homework and cared about our members and our business. They demonstrated high levels of flexibility, even suggesting additional creative ways to use Encoded technology. From the outset, it was clear they were exploring new ideas to help us work even smarter.”

Karen Coates,

Chief Operations Officer at The Wine Society

First Port Property Management

First Port Property Management is part of Peveral Property Management (PPM) one of the UK’s leading providers of residential property management services.

First Port Property Management implemented a interactive voice response (IVR) solution from Encoded to offer customers a round-the-clock automated payment option when paying service charges, ground rents and other items, such as a new key or security for communal entry doors.

Since implementing the new secure PCI DSS card payment solution, First Port Property management has been able to increase its contact centre opening hours and improved utilisation of existing resources.

Tracey McCabe,

Head of Customer Service,

First Port Property Management

Chapter 7. Summary

Using an automated secure payment system in your contact centre.helps you to achieve more by paying less. Accepting credit and debit cards via IVR is a cost effective and secure way of taking payments. It allows customers to make payments quickly and accurately while reducing agent transaction time and improving security both for you and your customers.

Business hours can be extended to provide a round-the-clock response, every day of the year, and seasonal spikes can be managed to take payments which would normally require temporary staff or costly overtime. Seamless integration with existing systems enables personlaised service and can free agent time to allow them to focus on more productive services to add value to customer experience.

Chapter 8. About Encoded

Encoded is a leading Payment Service Provider and pioneer of new and innovative secure payment solutions for contact centres. Encoded offers a range of card payment solutions designed to help organisations comply with PCI DSS, GDPR and the newly introduced Payment Services Directive (PSD2).

Encoded’s solutions are trusted by many of the world’s leading brands including, Samsung, Mercedes-Benz, BMW, Müller and Virgin, as well as a host of UK utility companies such as Green Star Energy, Severn Trent Water and Anglian Water.

Omni-channel solutions include:

- Agent Assisted Card Payments

- E-Commerce payments

- IVR Payments

- Mobile Apps

- PayByLink Mobile Payments

- Virtual Terminal Payments

.

Payment solutions for contact centres

Our suite of payment solutions for contact centres include Gateway Services, IVR, Agent Assisted Payments with Fraud Prevention Platform, eCommerce Payments and SMS PayByLink.

IVR Payments

Interactive Voice Response Payments (IVR Payments) is a method that allows callers to enter their card data via touch tones. This self-service process enables debit and credit card payments to be handled 24/7.

PayByLink

Agent Assisted Payments

eCommerce Payments

Gateway Services

Download our guides

Secure Contact Centre Payments brochure

What our customers say about us

“We needed to offer our members both fast and secure Payment Card Industry Data, Security Standard (PCI DSS) compliant payment methods and advanced e-commerce capabilities using automated technology. Encoded had done their homework and cared about our members and our business, even suggesting additional creative ways to use Encoded technology. From the outset, it was clear they were exploring new ideas to help us work even smarter.”

Karen Coates, Chief Operations Officer, The Wine Society

“We handle hundreds of thousands of calls every year that demand a broad knowledge of financial and legal matters as well as general property maintenance issues. Encoded presented a sound proposal that promised to deliver round-the-clock efficiencies in a cost effective package. The final overall approach and sophisticated IVR technology proved to be the perfect answer to our business problems.”

Tracey McCabe, Head of Customer Service, First Port Property Management

“We decided to refresh the online experience in response to customer demand and changes in the industry. It was a moment of clarity – Encoded was already handling our secure payments with data being fed into our billing system. We needed to create a front-end link so that customers could access this information themselves, rather than relying on speaking to an agent every time they wanted to make a payment or a change to their account details.”

Business Optimisation Manager,

Severn Trent Water

“One of the key reasons for choosing Encoded was to improve the team’s experience of managing large scale migrations from legacy payment systems. With Encoded’s in-depth knowledge of data security, PCI DSS compliance and the latest payment regulations, JT had confidence that the integration would be carried out within the project timescales and to budget.”

Tim Peach, Finance Operations Manager, Jersey Telecom

“From the outset, it was evident that Encoded grasped our requirements for an easy to deploy, fully transparent solution that could integrate seamlessly with our own IT systems. What is more, Encoded offered us a solid and highly scalable platform that promised to drive efficiencies whilst delivering the personal touch to those callers who needed it most.”

Collections and Recovery Department, One Savings Bank

“Along with the simplicity and highly configurable nature of Encoded’s solution, we were impressed by everyone’s professional, can-do attitude backed up by excellent support. Encoded offered a truly scalable solution that could grow with our business. In particular we trusted Encoded to support new ventures such as flexecash® which has already been adopted by a number of high street retailers.”

June Potts, Head of Customer Contact, Park Group

“Tens of thousands of calls relating to payment and meter reads are handled by sophisticated technology provided by Encoded. Encoded’s solutions have supported our business from day one, having been selected from a shortlist of four vendors for its ease of use, speedy implementation and cost-efficiency.”

Shell Energy

“Today, around 10% of all our sales are made using credit or debit card transactions. Our job is to make it easy for customers to pay for services swiftly and securely. Encoded listened carefully to our requirements, made sensible recommendations along the way and even adapted the technology to suit us. The whole experience ran smoothly and we were impressed by their level of knowledge and understanding of our business.”

Peter Doyle, Risk Manager,

Health-on-line

LATEST NEWS

IVR Payment articles you may be interested in

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Speak to the team

To discover how our secure payment solutions can free up your contact centre agents' time allowing them to focus on customer service, more complex enquiries and revenue-generating activities.